In October, Autumn Lodge in Armidale became part of Uniting and in doing so secured continuing access to quality aged care and retirement living for the Armidale community. Pride Living was selected by the Board of Autumn Lodge to guide it on a journey they had not previously undertaken, to assist them and the management team navigate through the process of identifying and selecting the future custodians of the legacy that is Autumn Lodge.

In this Insight, we share with our readers some key aspects of that journey.

Is a merger appropriate?

Is a merger appropriate?

Most boards dread the thought of a merger, often because it brings with it a sense of failure or the fear that the community who rely on and are invested in the facilities will not thank them for “selling out”. Initially, we work with the board to tease out what problem the merger is seeking to solve.

In the case of Autumn Lodge, the board had been unable to find appropriately skilled directors to provide the standard of governance now demanded under the Aged Care and Retirement Living Acts.

In addition to this, the assets were coming to the end of their use by date and a major capital works program was required to refresh the facilities. This was beyond the skills and capability of the board and management. We identified that a key attribute of the successful merger partner would be experience in developing and implementing master plans of significant scale.

We are currently working with another provider of Home Care and NDIS services who has similarly identified core issues with skilled board members. In their situation, scale to support the technology and marketing platforms they need to be successful in an increasingly competitive marketplace is a key weakness they are seeking to address.

Identifying and selecting the right merger partner

Identifying and selecting the right merger partner

Having identified the issues and solutions being sought, we then set about identifying potential organisations that, based on our knowledge of the sector, have the demonstrated skills and capabilities that are missing.

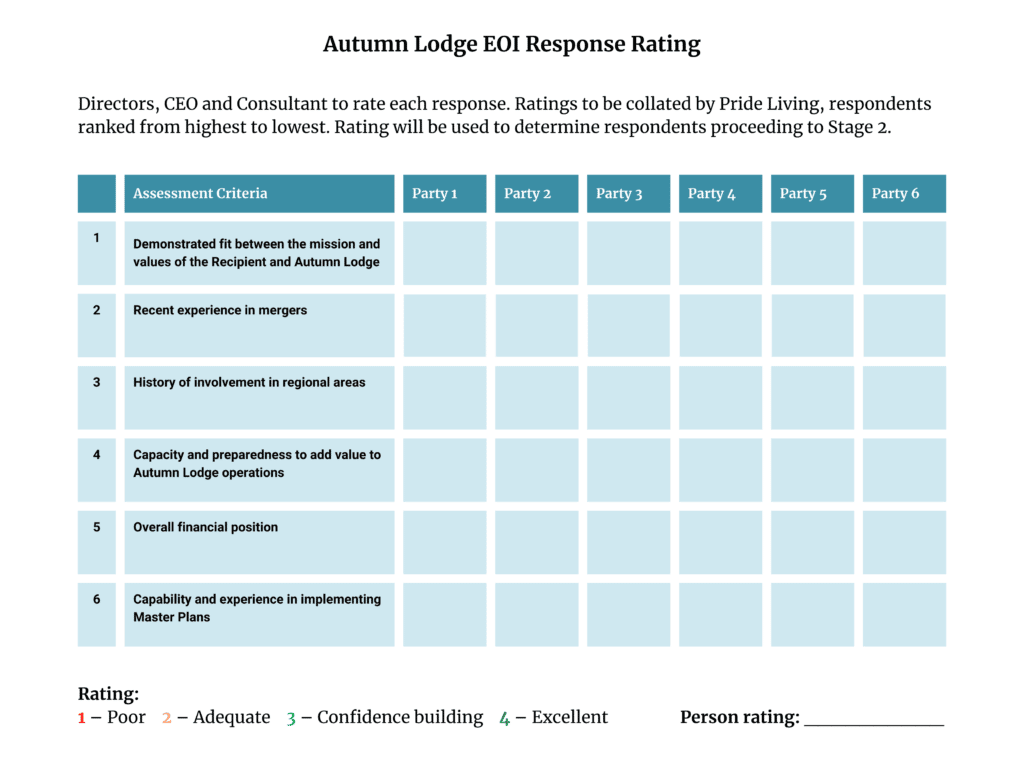

Once we have a target set of potential partners, (in the case of Autumn Lodge, we identified 12) we have in confidence conversations to determine if they wish to be part of an Expression of Interest (EOI) process. The EOI process is designed to draw out the values and mission alignment of the organisation considering the merger and to respond to key capabilities and outcomes sought from the merger.

In our process, the EOI responses are reviewed by the board who score them on an agreed set of attributes. We then moderate the scores and identify a short list of potential partners with whom the board will engage more deeply.

One of the key benefits of this process is that it identifies potential merger parties who are seeking to solve an internal problem by merging and those who have the capacity to truly add value to Autumn Lodge and by extension the Armidale community.

One of the key benefits of this process is that it identifies potential merger parties who are seeking to solve an internal problem by merging and those who have the capacity to truly add value to Autumn Lodge and by extension the Armidale community.

This process quickly reduces the list of potential partners to 2–4. These parties are then invited to give in-person presentations of how they approach mergers and what specific value they can bring to the organisation. From this, the number is then reduced to 1-2, which the board then considers in detail before making a call on which party to engage in due diligence.

Executing the merger

Executing the merger

Once we have identified the party that the board is most comfortable in being the right custodian for the legacy that has been created, we manage the due diligence process so that it is the least disruptive it can be and proceeds without any undue delay.

Due diligence is more than the incoming party understanding the details of the party that is to merge, it also involves a level of due diligence by the board of the merger partner who intends to assume responsibility for the activities.

At a practical level, the merger partner needs to develop some initial post-merger plans, including communications, onboarding employees into the new organisation, systems migration etc. The more the parties can engage with each other prior to settlement on the activities that will occur in the immediate days and weeks after the merger, the smoother the outcome for all concerned.

Lastly, there are the legal and procedural matters that need to be completed. Having advisers who have experience in these areas is a real asset to both parties.

Once the due diligence is on track, we get out of the way so the parties can work together to ensure that all stakeholders are supportive of the change.

Considerations for those contemplating a merger

Considerations for those contemplating a merger

If you are part of an organisation that is considering how to ensure continued access by your community to quality care and services, we encourage you to think through the following seven key elements of a merger:

Based on the mergers and sales that we have worked on, we have learned that:

Final thoughts

Final thoughts

It is said that the core goal of a corporate entity is to stay in business. When you relate this to a For-Purpose organisation, it would translate to – The core goal of the organisation is to ensure the continued access of its community to the services the organisation provides.

This starts with ensuring good governance and moves to the level of a sustainable operating model. With the fundamental changes occurring in the Aged Care and Retirement Living sectors, the governance practices and operating models of the past will need to adapt.

Mergers are a valid and reasonable option for many organisations. However, like with all change, it’s how you manage and respond to it that determines whether the change will be successful! Good governance actually requires governing bodies to consider whether a merger is in the best interests of its stakeholders.

How Pride Living helps

How Pride Living helps

Essentially, we see the role of the adviser in a merger as being to support the board and management in:

- determining if a merger is the right path for them,

- finding and assessing potential merger partners,

- advising on and managing communications,

- facilitating the due diligence process and

- ensuring the merger completes as intended.

Both Autumn Lodge and Uniting have expressed how seamlessly and smoothly the whole process of working with us as the core merger adviser was.