The Stewart Brown December 2018 survey results were recently released and shows a further deterioration of operating performance by residential providers. For the 12 months to December 2018, average facility EBITDAR prpa was $7,391, a steep decline from $9,830 EBITDAR prpa in December 2016.

While much of this decline is due to systematic changes, our work with Providers suggests that revenue is being left off the table.

The good news is, taking simple yet highly effective actions can plug revenue leakage. We explore three of these, adding up to $3,100 prpa to your bottom line:

- Managing respite days

- Higher accommodation supplement

- Reconciling to the Medicare statement

Managing respite day

The Respite Supplement is $93.36pd, this drops to $54.87pd if utilisation is less than 70% of nominated respite days. This translates to a loss of $38.49pd (41% reduction).

Assuming a facility uses 2 beds for respite (730 days), Table 1 shows the potential revenue leakage of missing the nominated respite days.

Table 1: Respite days

![]()

This loss is totally controllable, had the provider advised the Department they wanted to reduce respite days to 700 they would have achieved 70% (490 days).If 500 days was above the 70% threshold, they would have earned $46,230. In this scenario missing your 70% target costs $19,060. Assuming this was an 80-place facility this represents $238 prpa.

There is no excuse for missing your 70% respite threshold.

As our contribution to increasing provider viability Pride Living is happy to assist you to manage your respite days at no charge!

If you would like to know more call or email me at james.saunders@prideliving.com.au.

Higher accommodation supplement

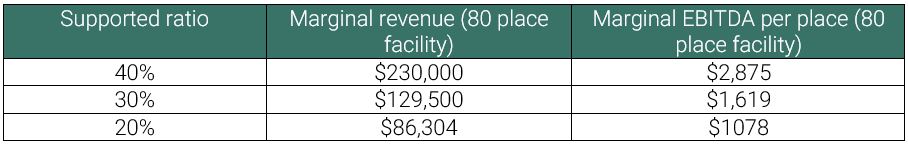

74% of providers are not maximising their accommodation supplement for supported residents. For an 80-place facility with a 40% supported ratio, not getting the higher supplement equates to potential revenue leakage of $2,875 prpa.

Table 2 provides an overview of the positive effect on EBITDA accessing the higher accommodation supplement can have using our example of an 80-place facility.

Table 2: Higher accommodation impact

We have assisted many providers to gain either pre or post refurbishment approval for the higher accommodation supplement. In some cases, providers had been told they would not comply only to find out they did.

Reconciling to the Medicare statement

Billing for the means-tested care fee and accommodation should always be reconciled to the Medicare statements.

One of the complexities with the means testing system is that Centrelink carries out the assessment, whereas Medicare pays the subsidy. Unfortunately, they don’t always talk to each other. As your funding is based on the Medicare statement, this is your source of truth rather than the Department of Human Service’s letter on your consumer’s funding status.

An additional layer of complexity is that consumer families may dispute charges on the basis that, they have not received the means testing results. If the Medicare statements show a means-tested care fee less than the maximum, then the results will have come through and families should be directed to Centrelink.

We have seen Providers both leak and overcharge significant levels of means-tested care fees and accommodation revenue because they did not reconcile to the Medicare statements.

Many Providers will have billing software which reconciles to the Medicare statements to manage this issue. However, if this is not you, our recommendation is that in the short term do the reconciliation manually with a view to the software solution in the medium to long term.

If you require assistance in plugging revenue leakage, contact me at james.saunders@prideliving.com.au for a free initial consultation.