The recommendations of the Royal Commission will have many positive effects on the standard of care residents receive and there may be an improvement in the funding of the system. However, despite all the rhetoric I’m yet to be convinced that Government funded aged care will not continue to be another safety net system. In this insight, we explore the three perspectives that allow providers to operate outside the safety net and share 3 winning tactics that have the potential to increase sustainability by over $7,000 per bed per annum.

When we analysed the 148 recommendations of the Royal Commission we found:

65% or 96 recommendations related to administration, regulation or transparency

23% or 34 recommendations related to policy directions

12% or 18 recommendations could positively impact the sustainability of providers

The $10 per resident per day is a welcome increase in funding and if providers don’t change their costs it will increase EBITDA by $3,650 per resident per annum. This will move a significant number of loss-making providers into profit. However, this is a short term tonic, not a long term fix.

Understanding the Regulation

The recommendations of the Royal Commission will have many positive effects on the standard of care residents receive and there may be an improvement in the funding of the system. However, despite all the rhetoric I’m yet to be convinced that Government funded aged care will not continue to be another safety net system. Consider the NDIS which, like aged care, is a human rights-based system. Already the Government is looking to turn this into a cost managed system – safety net, the minimum level of Government support to provide for those who cannot supplement their system needs.

The actions of the [Sustainability Action Taskforce] will make immediate changes to slow growth in participant numbers, slow growth in spend per participant and strengthen operational discipline, in accordance with the requirements of the NDIS Act and Rules,” the three-page document, marked “sensitive”, says. – The Guardian, 2021

If you need more convincing, consider these other examples of safety net systems:

Operating in a safety net system

Now that we have clarity on the direction of the regulation in aged care, we are encouraging our clients to truly engage on how to create sustainability when you operate within a safety net system; In essence, this involves:

1. Mindset – Accepting that the Government is never going to financially support a system beyond the minimum requirement. To do so is inconsistent with a “low tax” agenda

2. Strategic position – Providers in any of the above safety net systems who do best take the strategic position that consistent with consumer choice they will operate on a co-payment model where they manage the primary price-setting levers to their advantage

3. Sound tactics – Once you embrace the first two principles it drives you towards how you structure your operating model to provide consumers with the choice and service they want at a price you can sustainably afford.

Sustainability tactics with Pride

I’d like to share three tactics that we’ve helped our clients employ to ensure their sustainability!

Additional Services

Choice is about differential offers and these are associated with differential prices, think buying a motor vehicle, staying in a hotel, dining at a restaurant. Each of these involves choices that result in different prices. Similarly for the provider of aged care services (residential or home-based) it is implicit in providing a choice that there will be price differentiation. The base offer is specified care and services and nothing more. This is funded by the Government. After this, everything you provide is an additional service and should have a price attached to it. A $10.00 per day additional service charge, which can be afforded by a full pensioner translates to between $2,000 and $3,650 of marginal EBITDA per resident per annum.

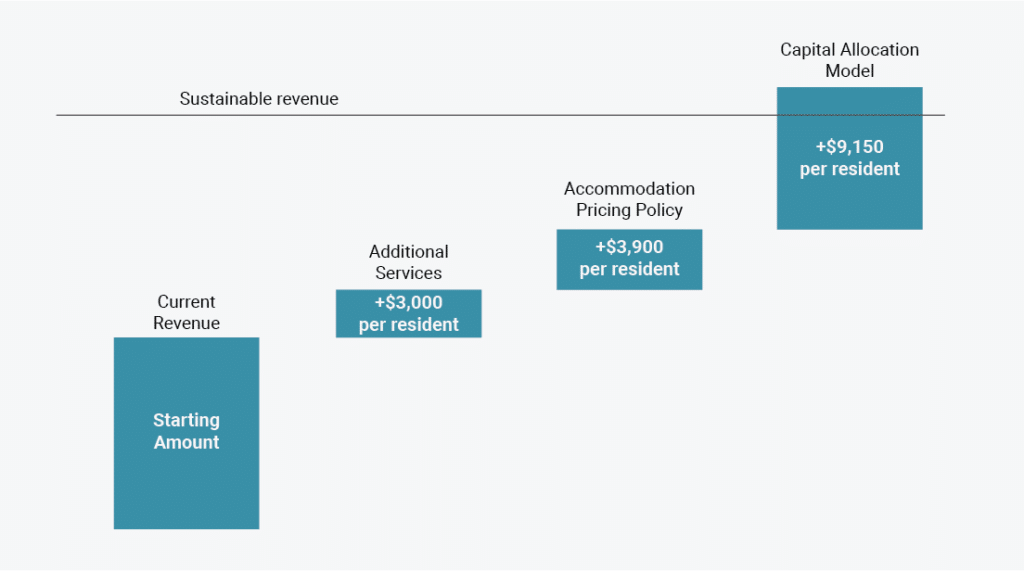

Additional services provide between $2,000 and $3,650 of marginal EBITDA per resident per annum.

Accommodation Pricing Policy

The arrival of low-interest rates caused an increase in the RAD providers were asking. However, this is not an accommodation pricing policy. Similarly equating your RAD with the value of houses is not an accommodation pricing policy. The truth is you do not “sell” places in an aged care facility. You effectively rent a specialised one bedroom fully furnished unit with significant community assets. The Government sets the safety net rent via the accommodation supplement, currently $58.69 per day or $24,442pa.

If you consider your accommodation charge from an equity perspective, then providing a self-funded resident with a rent below the safety net level is in effect providing a subsidy to those in the community who least need it. Not setting self-funded accommodation charges below the safety net is an accommodation policy. Such a policy translates to a minimum DAP of $58.69 and a corresponding RAD of $530,000.

According to the Stuart Brown data, the average RAD at Dec 2020 was $437,000. This equates to a DAP of $48 per day. An effective subsidy of $10.69 relative to the accommodation supplement. This equates to $3,900 lost EBITDA per resident per annum.

Implementing an accommodation policy equates to $3,900 EBITDA per resident per annum.

A Capital Allocation Model

In a report commissioned by the Department, the consulting firm EY suggested that the minimum liquidity a provider should have in relation to RAD is 10%. Industry liquidity has historically exceeded 30% of RAD liability. Clearly the sector does not have a sophisticated approach to allocating its available capital (equity and debt).

We looked at the average provider’s financial outcome in the Dec 2020 Stuart Brown survey and found the following:

If the average provider adopted a 10% liquidity policy and invested the additional funds to obtain a return equal to the foregone DAP (4.01%) it would result in marginal income of $732,000 to the average provider. This would eliminate the operating loss.

An efficient capital management model will provide for $9,150 EBITDA per resident per annum.

Notwithstanding the Govt response to the Recommendations of the Royal Commission, aged care remains a safety net system. In our experience the outcome you achieve from any system is a function of your mindset, your strategy and your tactics.

We’ve just completed a strategic planning workshop with a board who has adopted a mindset of “consumer choice” over a “safety net” model for their aged care operations. If you’d like to learn more about how to operate sustainably in a safety net aged care system, contact Bruce Bailey below.